Author: Willis Bennett

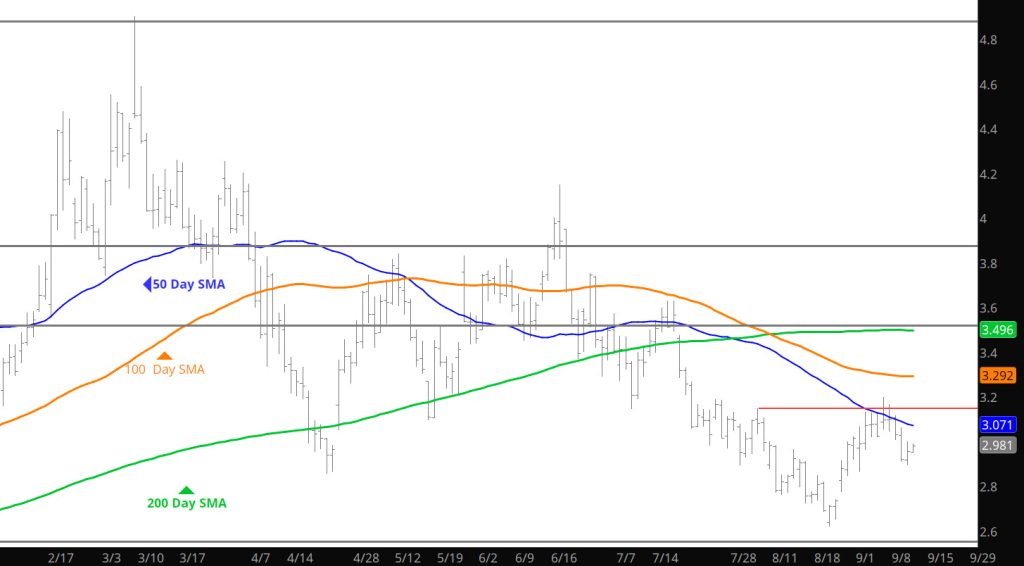

Negative Bias Reinforced

Storage Report Breaks Down Prices

Daily Continuous

The release of the storage data was more of an injection than expected but doesn’t have any sort of dramatic impact on prices through the winter (watch the prompt relationship to Jan’26) in the near term. That is where you will see any concerns about gas this winter to October.

Major Support: $3.00-$2.97, $2.843, $2.727, $2.648

Minor Support :

Major Resistance: $3.061, $3.16, $3.192, $3.25-$3.31,$3.39, $3.62, $4.168, $4.461,

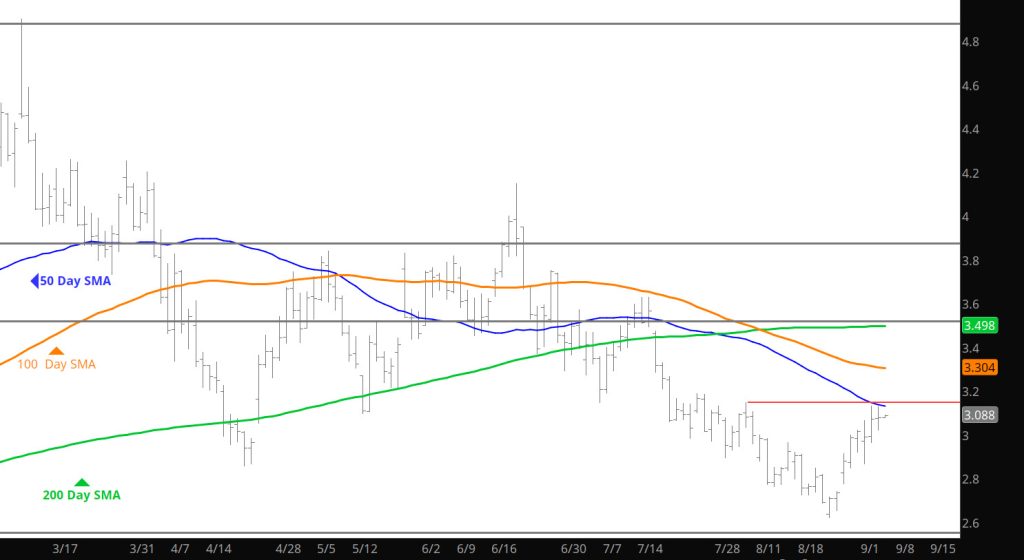

Initial Resistance Holds

Daily Continuous

Not sure if there will be more volatility today as prices and volume seemed wired in a tight range. Stick to selling premium in this type of environment.

Major Support: $3.00-$2.97, $2.843, $2.727, $2.648

Minor Support :

Major Resistance: $3.061, $3.16, $3.192, $3.25-$3.31,$3.39, $3.62, $4.168, $4.461,

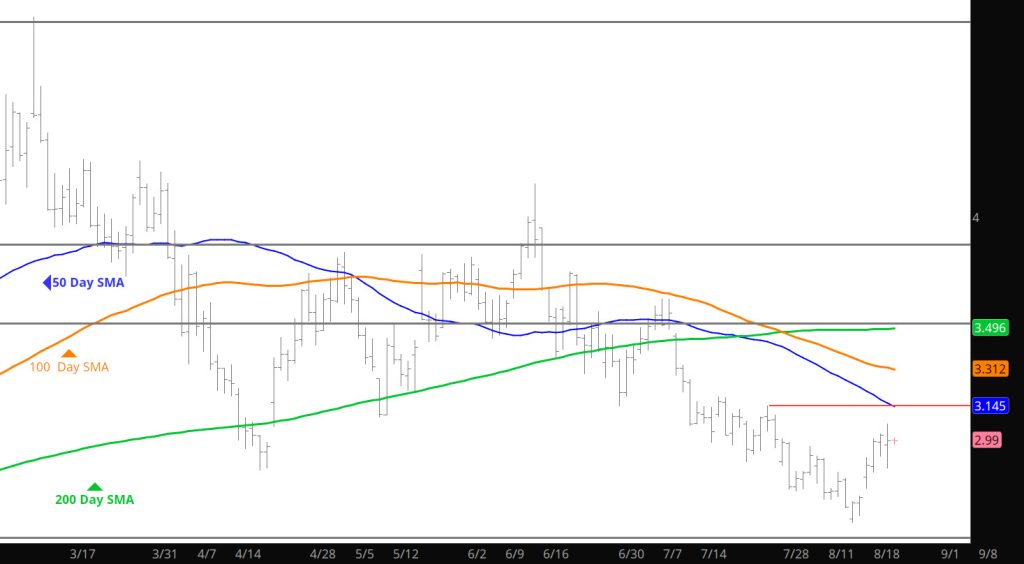

Resistance Tested

Similar to Recent Months Trade Begins Defining Range

Weekly Continuous

Although working against the current of seasonal price negative bias, until fading on Friday October gas had closed higher for eight straight days (it has been a while since any contract did that). For the holiday shortened trading week the prompt was the only contract to gain, + $.051, but November’s loss was negligible, $.005. The other ten months of the one year strip lost $.035 to $.071.

The price level attracting sellers was obvious…the declining 50 – day SMA. The highs of three of this week’s four trading days were within a penny of the gradually falling moving average. Interestingly enough, the continuation 50 – day SMA was an influence then as it was during the past week, once breached it became support for a rally that extended through October ‘24’s last trading day. Last year, following October ‘24s rally into expiration new prompt November gas up the gains and returned to test the 50 – day before December kicked off the real Q4/Q1 rally that finally peaked on March 10th.

The consensus of technical indications, which began to improve last week, improved enough to be rate neutral – negative after remaining negative for nine weeks. A week ago neither volume nor open interest confirmed lower lows…this week average daily volume and open interest increased along with October. Prompt gas reversed from more than two standard deviations below the 20 – week. This week’s higher trade tends to confirm that reversal. The daily ATR increased a little…from $.126 to .$131. The weekly ATR fell to $.380. The moderation of volatility may become a significant technical factor.

Major Support: $3.00-$2.97, $2.843, $2.727, $2.648

Minor Support :

Major Resistance: $3.061, $3.16, $3.192, $3.25-$3.31,$3.39, $3.62, $4.168, $4.461,

Working on the 50 Day SMA

Storage Release Has Little Impact

Daily Continuous

The storage release provided little impact on prices– which in on its own provides some support for the declines being limited.

Major Support: $2.843, $2.727, $2.648

Minor Support :

Major Resistance:$2.97-$2.99-$3.00, $3.061, $3.16, $3.192, $3.25-$3.31,$3.39, $3.62, $4.168, $4.461,

Recent Gains Hold

Daily Continuous

The gains in prices from the expiration and just after, held yesterday which may be an indication of a small change in short term bias. Recent months have held a rally only to be crushed under selling pressure. Now the market is facing a storage release which may give further indication of the bias preference.

Major Support: $2.843, $2.727, $2.648

Minor Support :

Major Resistance:$2.97-$2.99-$3.00, $3.061, $3.16, $3.192, $3.25-$3.31,$3.39, $3.62, $4.168, $4.461,

Prices Soften as Expected

Daily Continuous

Prices declined but recovered from some of the declines by day’s end. This leaves the contract starting to test some of the recent prompt contracts have established. While not conclusive, the rebound has brought some support that may allow for further gains.

Major Support: $2.843, $2.727, $2.648

Minor Support :

Major Resistance:$2.97-$2.99-$3.00, $3.061, $3.16, $3.192, $3.25-$3.31,$3.39, $3.62, $4.168, $4.461,