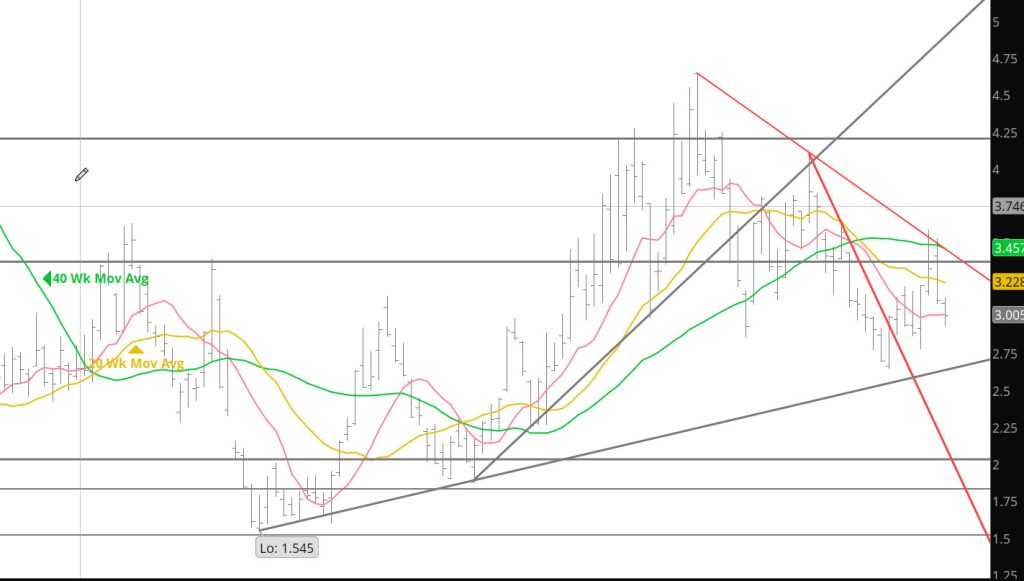

Weekly Continuous

November traded down to test the trend line rising from the August and September lows previously discussed recovered, but not sufficiently to close back within the range than had confined it for nine weeks. The lower boundary of that range…+/- $3.09 – $3.10, now becomes well – defined resistance.

The December contract, which continues to enjoy a substantial premium over November (currently $.733, a year ago on the same day December’s premium was $.481), traded down to the upper limit of November’s high volume reversal days on 10/02 and 10/08. $3.55 – $3.59 is well – defined resistance for the November contract and is support for December. Once inside/through that support, expect premium for December to diminish…just as November’s was forfeited. Unless/until December develops the sponsorship to overcome the trend line resistance (declining from its March/June highs) expect it to be guided lower by the trend line and it’s 20 – week SMA The value of that trend line on the December chart is $4.184 and falling about a nickel each week, December’s 20 week SMA is $4.188.

November continues to follow the pattern of the last two Octobers by trading an early high and then falling, although this week’s low on the 17th is a bit earlier. In ’23 prompt November traded its October low on the 23rd which was a higher low, higher than the September low which was higher than the August low. In ’24 November traded its first low after falling from a 10/04 high on the 21st. Just like this year November traded a daily reversal from that low and rallied smartly (from $2.210 to $2.582) but gave up the gain leading into expiration. From a trade perspective –be alert for a short covering rally but expect the same pattern to continue through October ’25.

Major Support: $3.06, $3.00-$2.97, $2.843, $2.727, $2.648

Minor Support :

Major Resistance:$3.167, $3.19, $3.39, $3.62, $3.80-$3.85, $4.168, $4.461,