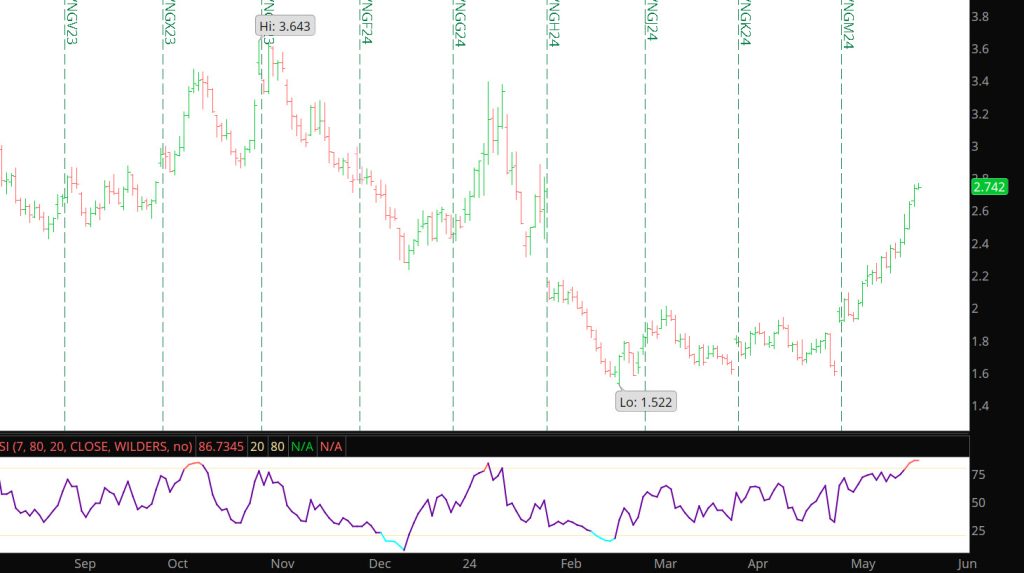

Daily Continuous with RSI

As most of you know, one of the tools I use to judge the condition of the market is the Relative Strength Index (RSI) a “momentum” indicator. When the calculation climbs above 80 (currently calculation is over 87), the market is characterized as being in the extreme over bought area. Looking at the chart above –notice that when the market hit the extreme zone in Oct ’23 and Jan ’24 there was a correction lower in the near term. Expect similar behavior with this current situation. The historical weakness around the holiday and the expiration coming — it would be prudent to expect a slight correction.

Major Support:, $1.595, $1.52-$1.511, $1.481, $1.312

Minor Support : $2.168, $2.12, $2.00, $1.967- $1.94

Major Resistance: $2.46, $2.67, $2.844