Month: November 2021

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

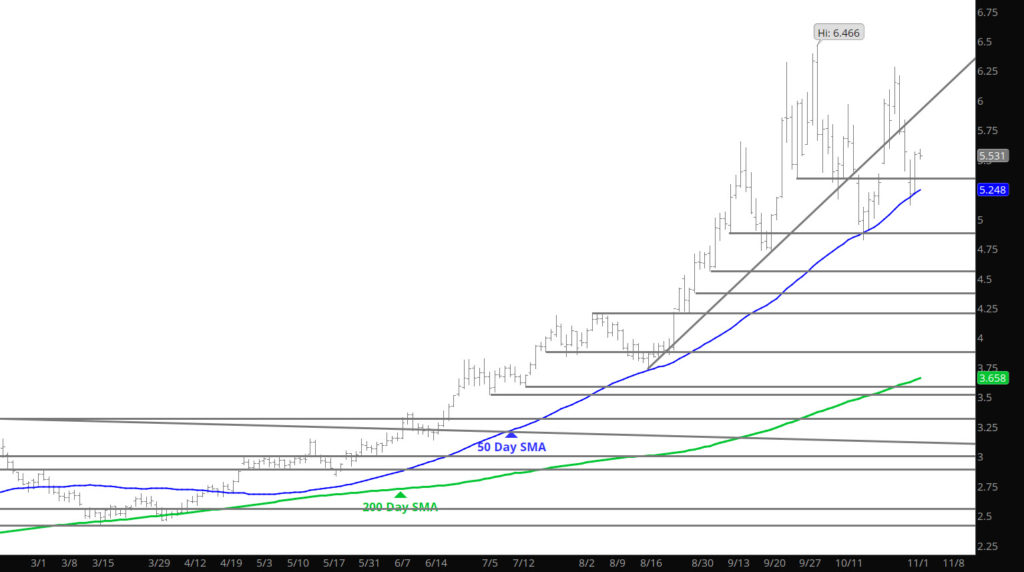

Commonly Watched Support Holds

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

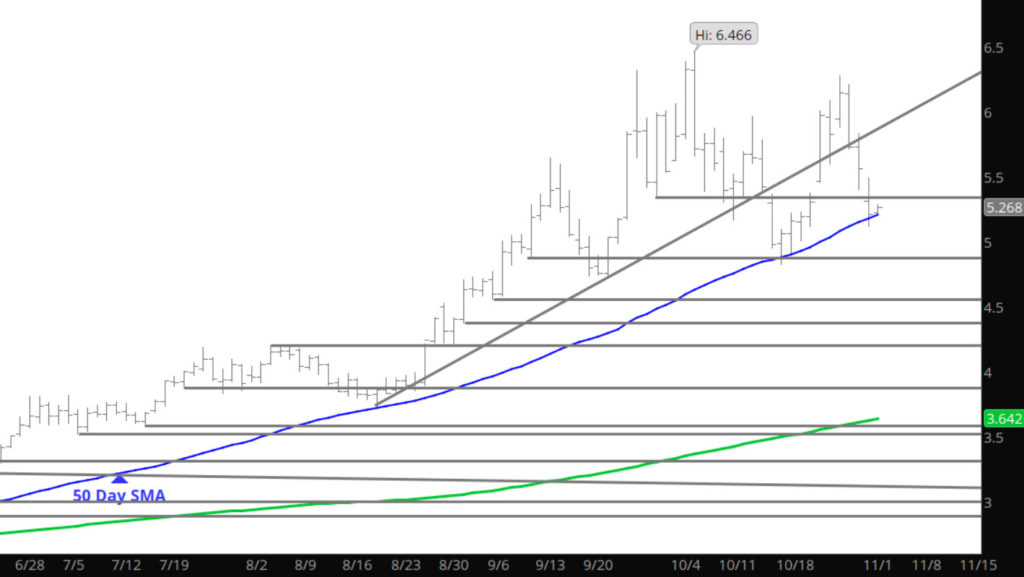

Sunday Night Closes Gap

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

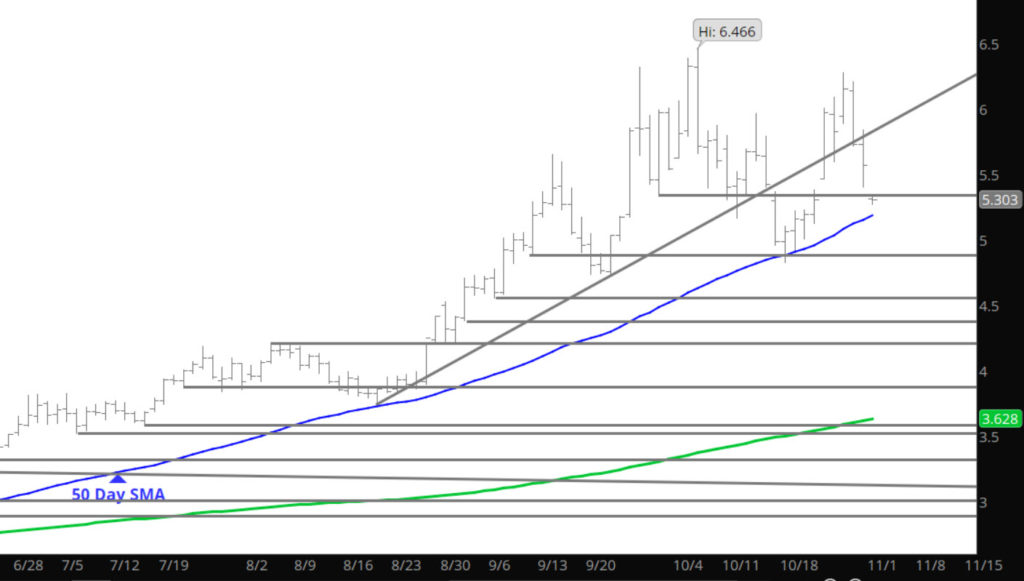

December Breaks Lower Tests Nov Support

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.